May 12th, 2023

“Spring has sprung. The grass is riz. I wonder where the sellers is.”

In addition to showing off my talent for committing classical poetry to memory, this old standard pretty well sums up the current state of affairs in our local real estate market. Listed properties are behaving like a normal spring market, with eager buyers creating lots of activity and quick, solid transactions. Offer review dates and multiple offers are once again the norm in many neighborhoods. But somebody shrunk the market!

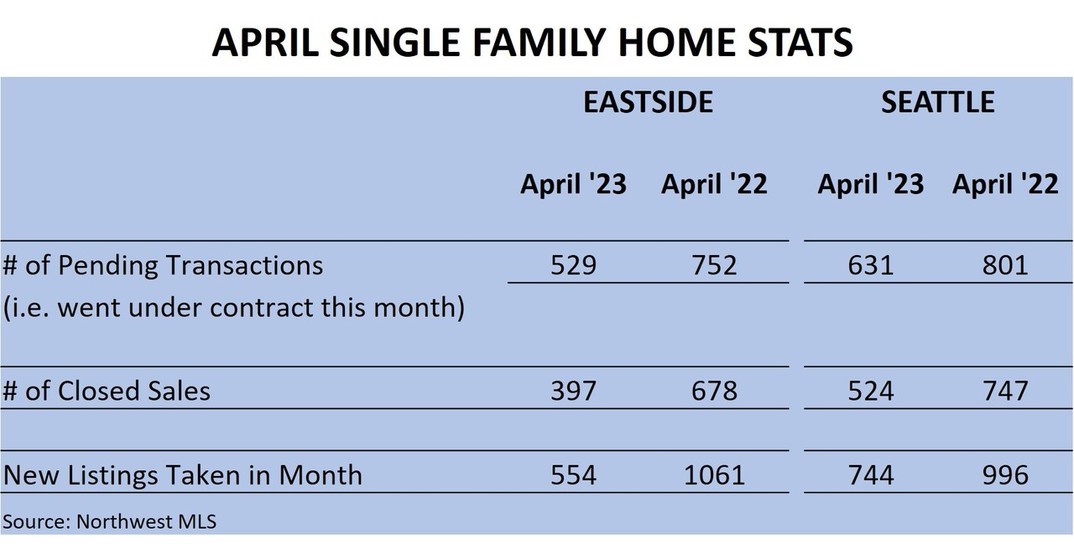

Higher mortgage interest rates and general economic uncertainty are paralyzing would-be buyers and sellers who are biding their time on the sidelines waiting for a sign that the water’s fine and it’s time to jump in the pool. Mimicking the national data we’ve seen in the press, the numbers below detail our local marketplace, which is at lower transaction volumes than we’ve seen in years.

| This market scarcity breeds urgency on the part of active buyers, which props up prices as buyers compete for limited inventory. Locally, the dip in prices that started last spring bottomed out around the first of the year and prices are starting to tick slowly up again. Across the Eastside the median price of a single-family home in April was 16% below its peak last April. But last month’s median price is already up 11.6% from the low point in December 2022. In Seattle, last month’s median single family home price was down 13.6% from its peak last May, but already 10.2% higher than at its low point back in January.

For many of us, the confluence of these forces and factors creates a confusing Rubik’s cube of data and information resulting in the paralysis mentioned above. Let me try to boil it all down. For sellers, the lower volume market creates an invaluable opportunity to list your property with little or no direct competition. Being the only game in town gives you the best chance of landing a quick, top dollar sale on your terms. The time is now! Buyers who have been searching for the market’s bottom may have found it. Both home prices and mortgage interest rates have stabilized over the past few months and now is the time to lock in last year’s price correction. You may have to compete for your dream home, but not at the price points – or intensity level – of a year ago. Opportunity knocks. I can guide you through the search, bidding and negotiation process and also introduce you to some clever mortgage professionals with programs that take the sting out of today’s interest rates while you wait to refinance at what will hopefully be more reasonable rates down the road. Waiting for rates to moderate before jumping in will likely cause you to miss out on today’s prices. That’s my take. Let’s talk about what’s going on in your specific neighborhood and put together a plan to get you where you want to be. Operators are standing by. Rip. |