Spoiler alert: The fundamentals of our real estate market have changed and if you are considering a purchase or a sale (or both) this year you’ll need to start with a new set of assumptions. Below are some facts and figures on the new market realities and a few ideas to help you push the reset button.

Would-be sellers should know that there are still plenty of eager buyers out there at all price points. They bear no resemblance, however, to the frenzied, quick-trigger buyers of the recent past. Lots of deals are still being done and sellers are having a lot more success than the press would have you believe. When thinking about a sale, considering where you fit into the timeline below will serve you better than trying to time your listing to the market’s top tick. (Click on the graph for an interactive version that lets you see specific time periods and add lines to view other markets.) The Cliff Notes version is that through October (latest Case-Shiller numbers available) average property values around here have increased by more than 2.5 times in the past 10 years (+256%), and by almost 3.5 times in the past 20 years (+343%). Some neighborhoods have done even better. It has been quite a ride.

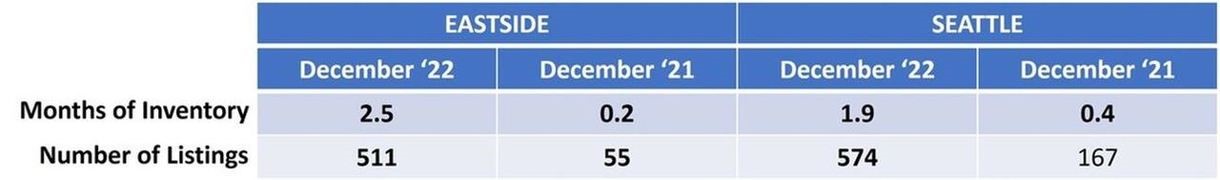

For buyers, today’s choices and options are staggering compared to what was on the market a year ago. The chart below compares data on top line single family home inventory for December across the Eastside and Seattle with a year ago. Inventory is building as the market continues to adjust to the new reality and many listings take longer to sell. As a result, buyers have more time and more bargaining power than they have in years.

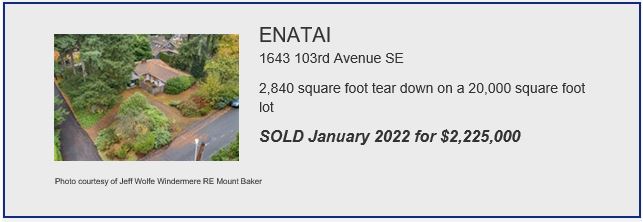

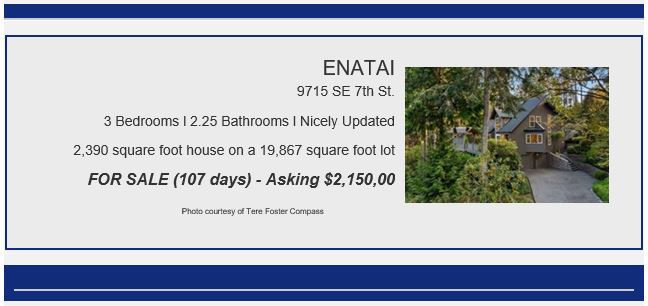

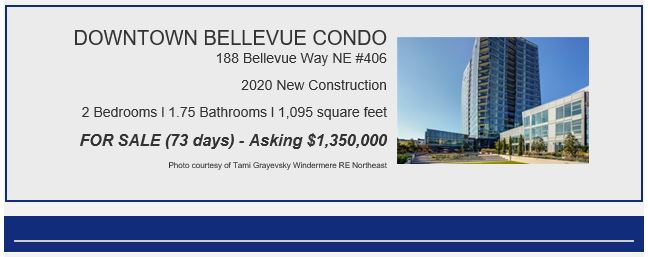

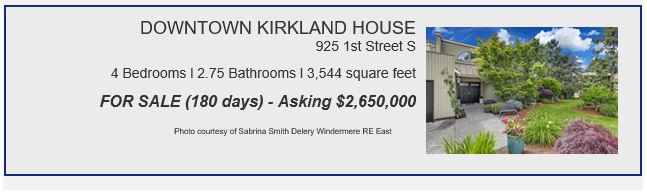

More interesting than the quantity of inventory available is how much more you can expect to get for your money today. Below are 3 examples of closed sales from around this time last year, each compared to a currently active listing in the same neighborhood. It’s amazing how much more house or condo you get for the money, and keep in mind that the active listings below have been on the market for between 3 and 6 months and will likely sell below their current list prices. What a difference a year makes!

Finally, I know that today’s interest rates can create some payment pain for those looking to capitalize on these opportunities. You should know that there are workarounds available to help alleviate the pain. I know several lenders offering buy down programs that reduce the interest rates for the first 2-3 years of a loan. Some are also offering borrowers free refinancing for up to 3 years. If you believe, as I do, that property values will head back up and interest rates will head back down in that timeframe, when the dust settles we’ll look back and reflect on the great opportunities today’s market presented.

Let me know how I can help.

Rip.