JUNE 16, 2022

by Rip Warendorf

Last month I wrote that the market was “shifting a bit beneath our feet”. Well, I’m back to tell you that things have officially shifted. Across the region, a noticeable decrease in demand has caused prices to moderate, inventory to grow (though it’s still at historically paltry levels) and time on market to increase. We’re not there yet, but it feels more like a balanced market around here than it has in years. Here’s a quick look at some of the latest market trends along with some color commentary, which is worth exactly what you paid for it!

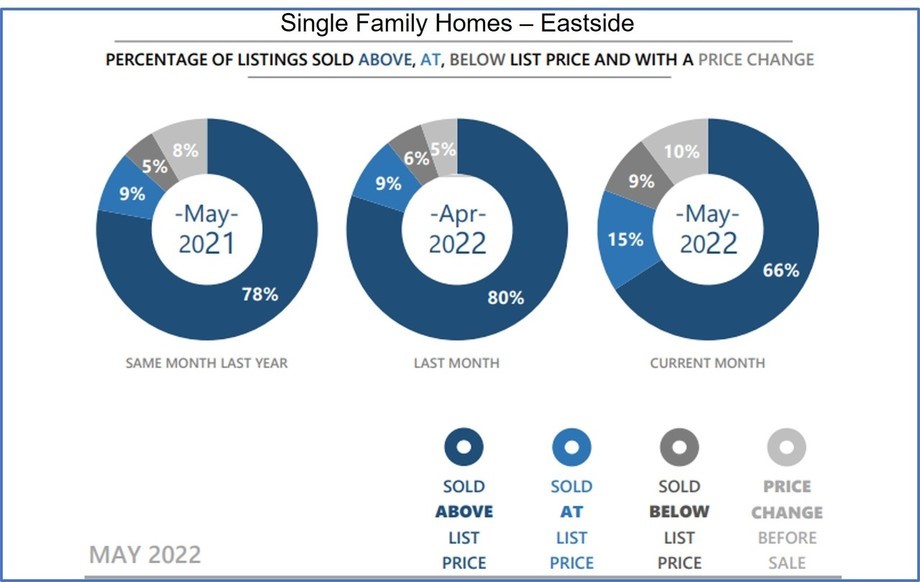

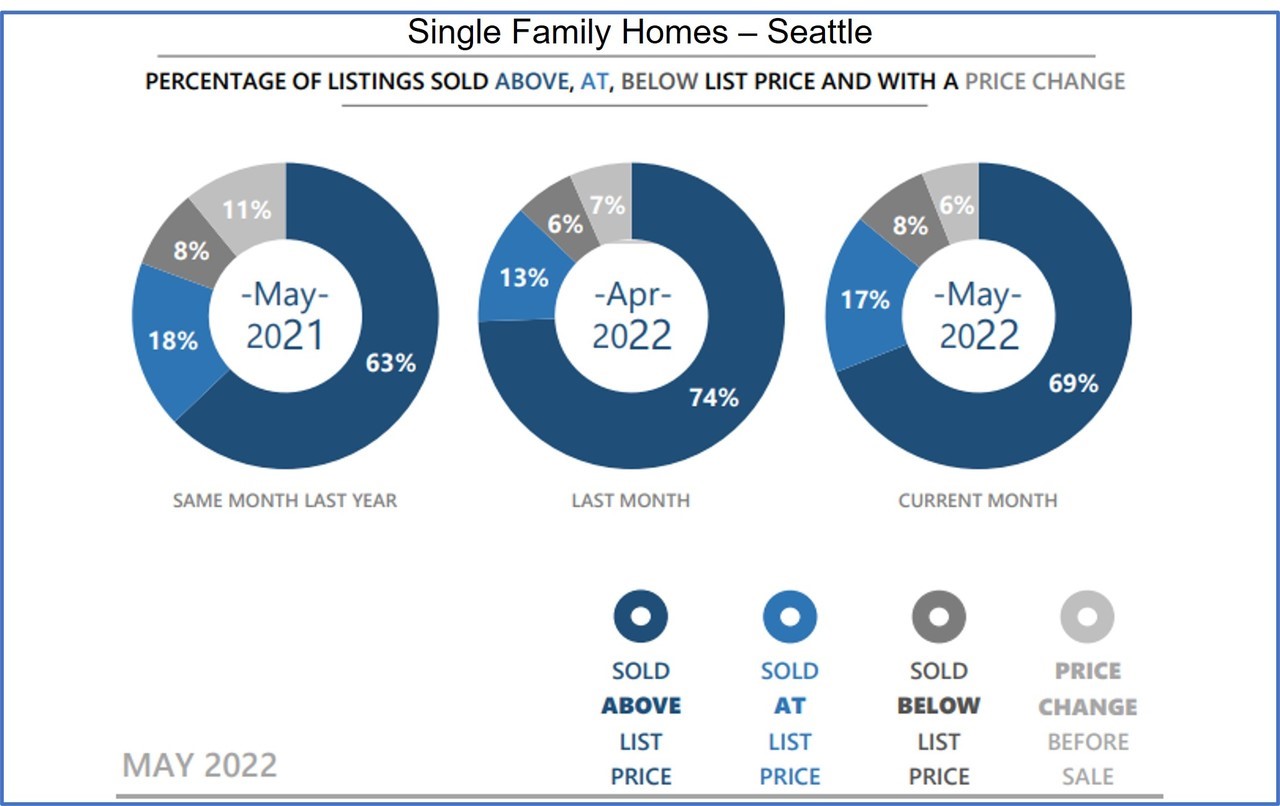

For starters, the median price of a single family home on the Eastside in May was down 8% vs. April. May’s prices were still about 22% ahead of a year ago, but the recent moderation is indicative of the changes we’re seeing out in the marketplace. In the Seattle market, which had not seen as steep a run up in prices as on the Eastside, prices remain basically flat for May (+.5% month over month).

The graphs below paint a revealing picture, providing kind of a “heat check” for our market. Specifically, while a large percentage of single family homes continue to sell above their asking price, that percentage is dropping due less overall demand and heightened price sensitivity on the part of buyers. (Note: On the Eastside the 66% “sold above asking” number is down from its peak of 87% back in February. April’s 74% is the high water mark for Seattle.) While we’re nowhere near the bear market territory of some other well-watched markets, the trend is clear.

Whether buying or selling, those considering a real estate transaction in the next few months will benefit from a thorough, professional, data-driven bidding or pricing strategy. Happily, buyers no longer have to assume that listing price plus 15% is the minimum price of entry. But what is the right number? Sellers too need to dial in the right asking price in order to be successful and not languish on the market. It’s no longer safe to assume that 15 offers with no contingencies will be waiting on review day. Accurate pricing, premium marketing and skilled negotiation are all back at the forefront in our brave new world. .

Some general rules apply when developing a pricing or bidding strategy in todays environment. First, the more recent the data being used the better. In a rapidly changing market, 6-month-old comp sales are not terribly useful. By the same token, in today’s market, currently active listings, which didn’t add much value when the market was on fire, can speak volumes depending on how long a property has been for sale. A well-connected broker can also access lots of valuable information not available through public channels (read: Zillow, Redfin, Seattle Times) to help crystallize an action plan moving forward.

In short, make sure you are getting solid input before making any decisions. A quick conversation, including some real time data is a great way to get all your goals and options on the table.

Operators are standing by…